Snowmobile and ATV maker Polaris Industries Inc. announced that its first quarter profit rose 26 percent as a huge jump in snowmobile and rising off-road vehicle sales offset weaker sales of on-the-road vehicles.

Snowmobile and ATV maker Polaris Industries Inc. announced that its first quarter profit rose 26 percent as a huge jump in snowmobile and rising off-road vehicle sales offset weaker sales of on-the-road vehicles.

Despite concerns about customer “timidity” because of U.S. payroll tax increases, as well as economic risks in North America and Europe, Polaris raised its outlook for the year. It said new products should help fuel growth in the second half of the year.

The Minneapolis company’s net income from January through March was $75.5 million, or $1.07 per share, compared with $60.1 million, or 85 cents per share, a year earlier. Revenue grew 11 percent to $745.9 million.

The performance beat Wall Street’s expectations. Analysts polled by data provider FactSet expected earnings of $1.01 per share on revenue of $751.6 million.

Off-road vehicle revenue increased 7 percent to $541.3 million on strong gains from new midsize utility vehicles, the company said.

Snowmobile revenue more than tripled to $14.7 million, as more snow fell this winter, and snow stayed on the ground for longer.

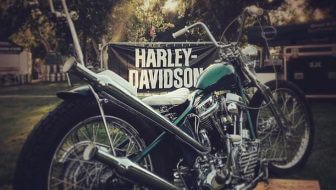

On-road vehicle revenue — Victory and Indian motorcycles and GEM and Goupil electric vehicles — fell 3 percent to $62.9 million because of a late start to spring this year. Unseasonably warm temperatures had also boosted sales early in 2012. Polaris is investing heavily in the rebirth of the Indian Motorcycle brand, which it bought in 2011.

Parts, garments and accessories revenue jumped 27 percent to more than $127 million.

The first-quarter earnings and revenue set records for the company, Polaris said in a statement. Based on those numbers and the acquisition of Aixam Mega that closed this month, Polaris raised its full-year guidance. The company now expects 2013 profit of $5.05 to $5.20 per share, up from a previous forecast of $4.85 to $5.05 per share. It predicted that revenue would grow 12 to 15 percent, to about $3.59 billion to $3.69 billion. Previously it projected sales growth for the year between 7 and 10 percent.

That’s in line with what analysts were predicting for this year: Profit of $5.16 per share on revenue of $3.63 billion.

Shares fell $1.40, or 1.7 percent, to $83.83 just after the opening bell.